The Important Overview to Independent Adjuster Firms in Insurance Claims

The Important Overview to Independent Adjuster Firms in Insurance Claims

Blog Article

The Ultimate Career Course for Independent Insurance Adjusters in the Insurance Coverage Sector

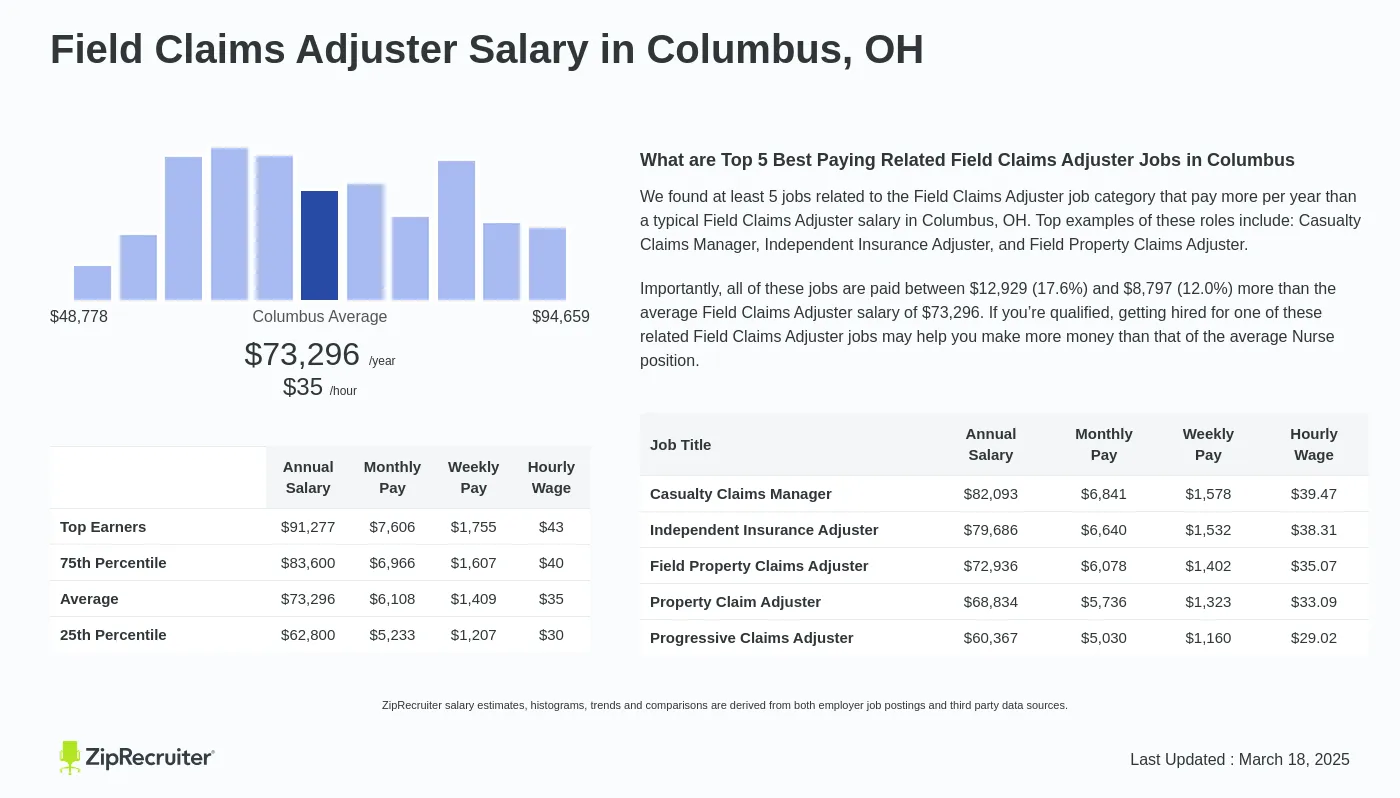

Browsing the intricate web of chances within the insurance policy market can be a difficult yet fulfilling trip for independent insurance adjusters looking for to carve out an effective career course. From developing crucial abilities to going after advanced qualifications, the ultimate job trajectory for independent insurers is a diverse terrain that demands calculated planning and constant development.

Recognizing the Insurance Industry Landscape

Comprehending the insurance coverage market landscape is crucial for independent insurers to browse the complexities of this market successfully and efficiently. The insurance policy industry is a vibrant and vast sector that encompasses different types of insurance coverage, including home, casualty, life, and health insurance - independent adjuster firms. Independent insurance adjusters need to have a thorough understanding of the different types of insurance coverage, insurance coverage limits, guidelines, and market trends to master their duties. By staying notified about industry developments, such as emerging modern technologies, regulative modifications, and market needs, independent insurance adjusters can much better serve their clients and make educated decisions during the insurance claims adjustment procedure.

Furthermore, a deep understanding of the insurance industry landscape allows independent insurers to construct solid connections with insurer, policyholders, and various other stakeholders. By having a strong understanding of exactly how the market operates, independent insurers can successfully discuss settlements, resolve disputes, and advocate for fair claim results. Overall, a thorough understanding of the insurance market landscape is a fundamental element for success in the area of independent adjusting.

Establishing Necessary Abilities and Know-how

In addition, a strong grip of insurance regulations and plans is crucial. Adjusters need to remain current with industry standards, regulations, and guidelines to make sure conformity and offer precise guidance to clients - independent adjuster firms. Furthermore, problem-solving skills are important for independent insurance adjusters who often run into difficult scenarios that call for fast thinking and cutting-edge solutions to fulfill client needs

Continual discovering and expert advancement are vital to remaining affordable in this area. By sharpening these essential abilities and competence, independent adjusters can develop successful jobs in the insurance market.

Building a Solid Expert Network

Establishing durable connections within the insurance coverage industry is critical for independent insurance adjusters seeking to advance their occupations and expand their possibilities. A strong professional network can provide useful support, understandings, and cooperation possibilities that can improve an adjuster's skills and online reputation within the sector. Building partnerships with insurance coverage carriers, declares supervisors, fellow insurers, and various other industry specialists can open doors to brand-new assignments, mentorship chances, and potential referrals. Going to market conferences, networking occasions, and involving with colleagues on specialist platforms like LinkedIn can help independent adjusters broaden their network and remain upgraded on sector fads and finest methods.

Moreover, networking can likewise cause partnerships and cooperations with various other specialists in associated fields such as insurance policy representatives, contractors, and my review here lawyers, which can further enhance an insurance adjuster's capacity to supply reliable and thorough insurance claims solutions. By actively investing in structure and preserving a strong specialist network, independent adjusters can place themselves for long-term success and development in the insurance sector.

Progressing to Specialized Insurer Duties

Transitioning to specialized adjuster duties calls for a deep understanding of niche locations within the insurance coverage sector and a commitment to continual discovering and expert advancement. Specialized insurer functions supply possibilities to concentrate on specific sorts of insurance claims, such as residential property damages, bodily injury, or employees' payment (independent adjuster firms). These duties demand a higher level of knowledge and often call for added accreditations or specialized training

To advance to specialized adjuster positions, individuals need to take into consideration seeking industry-specific certifications like the Chartered Home Casualty Underwriter (CPCU) or the Affiliate in Claims (AIC) classification. These credentials demonstrate a commitment to mastering the intricacies of a certain location within the insurance coverage field.

Furthermore, obtaining experience in broadening and handling complicated cases expertise of appropriate laws and guidelines can improve the possibilities of transitioning to specialized functions. Developing a solid expert network and looking for mentorship from skilled insurers in the desired particular niche can additionally supply open doors and beneficial insights to innovation chances in specialized insurance adjuster positions. By continuously sharpening their abilities and remaining abreast of you can try these out market patterns, independent insurers can place themselves for a successful profession in specialized functions within the insurance market.

Getting Professional Certifications and Accreditations

Earning specialist certifications and accreditations in the insurance market signifies a commitment to specific know-how and ongoing expert advancement past conventional insurer functions. These qualifications validate an adjuster's knowledge and skills, setting them apart in an affordable industry. Among the most identified certifications for adjusters is the Associate in Claims (AIC) classification, used by The Institutes, which covers crucial claim-handling concepts, policy evaluation, and lawful factors to consider. Another prestigious certification is the Chartered Property Casualty Expert (CPCU) designation, showing a deep understanding of insurance policy items and procedures.

Final Thought

In conclusion, independent insurers in the insurance policy sector can accomplish occupation success by recognizing the market landscape, establishing vital skills, constructing a solid expert network, advancing to specialized duties, and getting specialist qualifications. By adhering to these steps, adjusters can improve their competence and credibility in the area, eventually leading to increased opportunities for development and success in their careers.

Additionally, a deep understanding of the insurance coverage sector landscape makes Our site it possible for independent adjusters to develop strong partnerships with insurance companies, policyholders, and various other stakeholders. Constructing a solid expert network and looking for mentorship from seasoned adjusters in the desired niche can also provide open doors and valuable insights to improvement chances in specialized insurer settings. By continuously developing their skills and staying abreast of industry fads, independent insurance adjusters can position themselves for an effective career in specialized functions within the insurance coverage industry.

Moreover, insurers can pursue certifications specific to their field of interest, such as the Qualified Catastrophe Danger Administration Specialist (CCRMP) for disaster insurance adjusters or the Qualified Vehicle Evaluator (CAA) for automobile claims experts. By obtaining specialist certifications and certifications, independent insurers can expand their job possibilities and show their devotion to quality in the insurance policy market.

Report this page